In this regular column, Club Vita’s longevity experts will help you visualise the often abstract world of longevity risk by introducing some of their favourite charts.

In this edition of Top Charts, Alan Garbarino looks at what proportion longevity makes up of the total funding risk of pension schemes in the UK.

Question:

What proportion does longevity make-up of the total funding risk of pension schemes in the UK?

Answer:

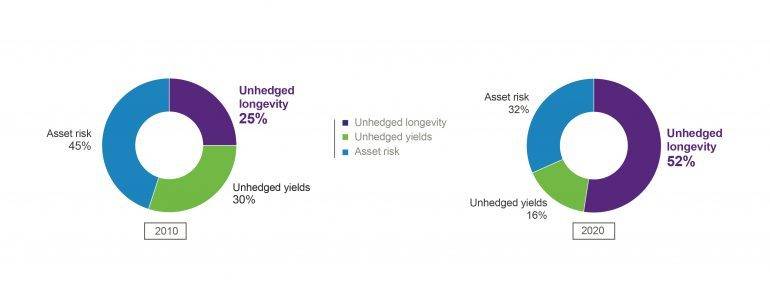

In 2020, over 50% of the total funding risk of pension schemes in the UK was due to longevity risk.

Over the past 10 years we have seen pension schemes in the UK dramatically reduce their exposure to asset risk and hedge their exposure to volatility in funding yields.

Change in asset split between equities and bonds for UK pension schemes

Source: The Pension Protection Fund’s (PPF) Purple Book 2020

This has left longevity risk as the largest remaining unhedged risk; in fact, the remaining unhedged longevity risk now makes up over half of the total funding risk for pension schemes in the UK.

Change in composition of funding risk for UK pension schemes

Source: Club Vita analysis based from information in the Pension Regulator’s Scheme Funding Analysis 2020 & 2010 and the PPF’s Purple Books, approximately converted. Figures show the drivers that would increase the deficit in the average of the worst 5% (1 in 20) outcomes.

Current longevity risk protection options (buy-in, buy-out and longevity swaps) broadly offer 100% longevity protection but are out of reach for many UK schemes. Is being able to protect more easily against some of the risk, say 50%-80%, better than hedging nothing?

Key takeaways

- The reduction of asset risk and hedging of volatility of funding yields over the last 10 years means that longevity risk is now the largest unhedged risk for pension schemes in the UK.

- Longevity risk now makes up over 50% of the total funding risk of pension schemes in the UK.

- There is clearly a need for affordable and easily transactable longevity risk protection.

The key questions is: How should pension schemes most effectively hedge this longevity risk?

What do you think?

What do you think?

Let us know your thoughts and comments on this publication on our Friends of Club Vita LinkedIn Group