On a day where many of us are fortunate to be celebrating the people we share our lives with (and possibly frantically buying a Valentine's card and gift on the journey home) it seems timely to reflect on the impact companionship has on longevity.

14 February 2020

Many have studies have shown that companionship in later life conveys a longevity benefit. In many ways this is obvious. Psychologically it gives a purpose to live for; practically it gives someone to call for emergency aid should you have an accident / heart attack etc...

A few years ago we started to look at this in the UK Club Vita data. UK DB pension plans have a legal obligation to provide pensions to a spouse. This limited us to exploring how the loss of a companion leads to elevated mortality for the widow(er). Our Grieving Widows paper noted how this impact is seen consistently across socio-economic groups, and is largest in the year following bereavement.

In contrast, participants in Canadian and US DB pension plans don’t automatically get a pension payable to their spouse. Instead the individual choses whether to take the pension in full payable to just themselves (“single life”), or to take a reduced pension with the continuation of (partial) pension upon their death to their spouse (“joint life). This difference means we can use the Canadian data to explore the “positive” impacts of companionship on longevity.

Yes, there are some people who have a companion who don’t take the “joint life” option – perhaps because each person has enough pension not to need this protection. However, in general those who elect a joint life pension have a companion that they wish to provide security to, whilst those absent of a companion will take the “single life” option.

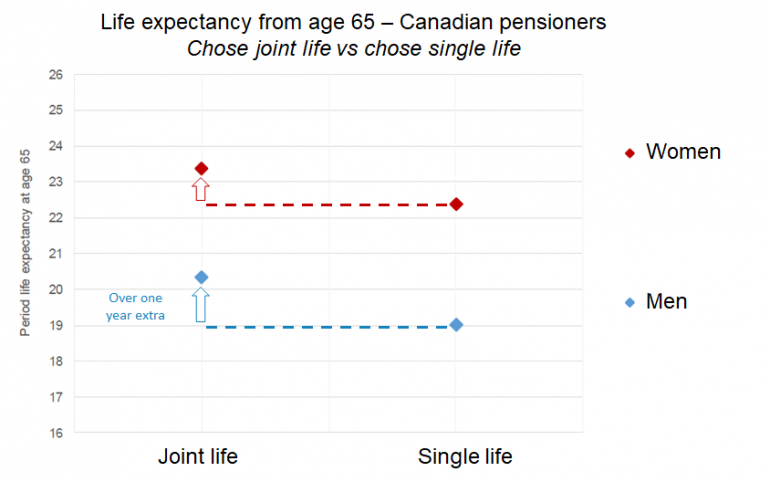

The longevity outcomes for the two groups are very different with the “joint life” group live over a year longer1. This difference persists when we control for factors such as pension amount and socio-economics/lifestyle; and from this month is reflected in our Canadian VitaCurves. We also expect to be building it into our next edition of our US VitaCurves.

1 Based on life expectancy from age 65.