VitalStatistics

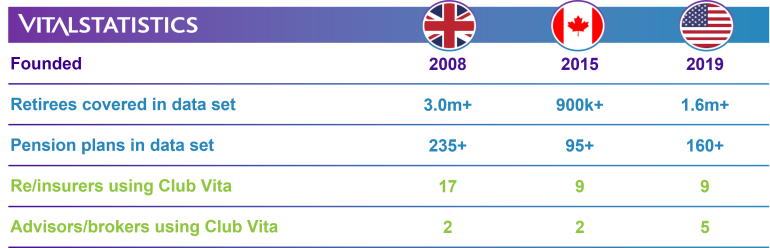

Over 400 leading DB pension funds pool their data through Club Vita in either the UK, US or Canada.

Our data sets now cover over 1 in 4 UK DB pensioners and 1 in 4 Canadian DB pensioners, with US data gathering rapidly catching up.

Our models are fast becoming the industry’s common currency with over 25 re/insurance users and 8 advisors/brokers using Club Vita worldwide.

"Data drives pricing"

Hamish Watson of Scottish Power, reflecting on his learnings from procuring a longevity hedge

Find out more

Find out how our unparalleled insights can benefit your fund