25 May 2022

Question:

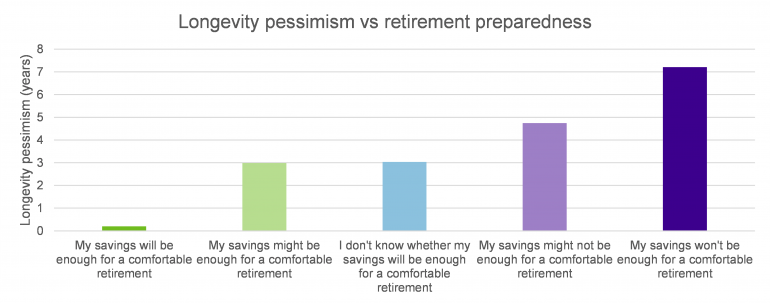

Is there a correlation between how financially prepared someone feels for retirement and how good they are at estimating their life expectancy?

Answer:

Yes, the more financially prepared people feel for retirement, the better they are at predicting their life expectancy.

In last month’s Top Charts we saw how men and women in Canada, the UK and the US in our Longevity, lifestyle and retirement perception survey, 2022 all underestimate how long they are expected to live – exhibiting a phenomenon known as “longevity pessimism”. We also asked our respondents how financially prepared they felt for retirement. The correlation between the two answers was striking.

Source: Club Vita’s Longevity, lifestyle and retirement perception survey, 2022. A survey of 3000 people aged 40-60 across Canada, the UK and US. Full details in the report.

Key takeaways:

- The more financially prepared people feel for retirement, the better they are at predicting their life expectancy.

- This could be as a result of people either engaging entirely or not at all with the process of retirement planning.

- This raises the concern, that the people who feel the least financially prepared for retirement have also, on average, underestimated their life expectancy the most, so they may be even less prepared for retirement than they think.

The key questions are:

What is causing the inverse correlation between retirement preparedness and longevity pessimism? And what can we do to help people make better retirement decisions?

For further details of longevity pessimism and correlations with other survey responses you can download the report here:

Club Vita’s Longevity, lifestyle and retirement perception survey, 2022

We presented the results of our survey as well as a discussion around behavioral drivers of mortality in a recent webinar. You can watch a recording and download the slides here:

Do you care enough? Behavioral drivers of longevity and retirement outcomes

What do you think?

Erik Pickett, Actuary and Chief Content Officer

Erik Pickett PhD FIA CERA

Erik leads the dissemination of Club Vita’s insights and analytics. He began his career as a mathematician, working at a number of universities around Europe, while moonlighting as a part time street performer. He transitioned to the world of actuarial science in 2011, retaining his passion for engaging communication, training first as a pensions actuary with Mercer and Hymans Robertson and later specializing in longevity analytics with Club Vita.